Welcome!

Blockchain Institute

June 2020

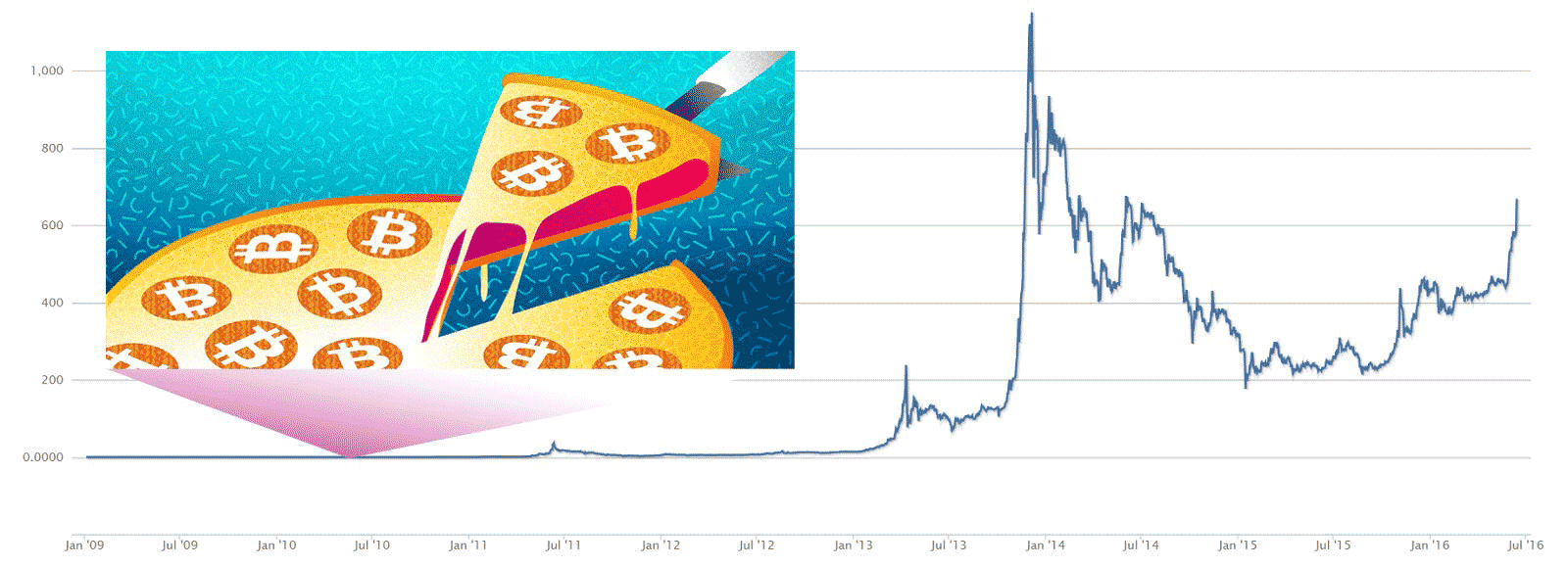

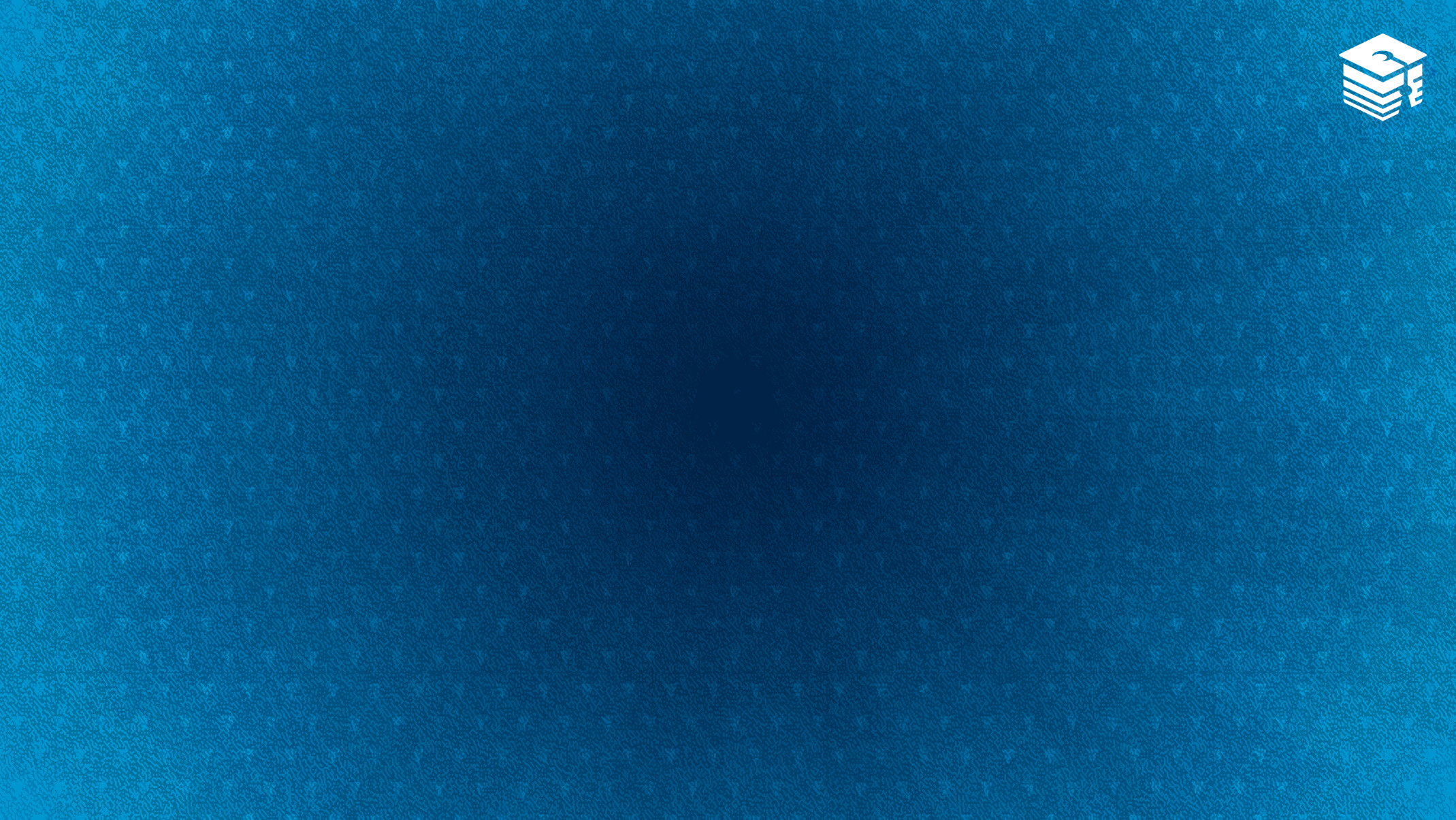

This guide will give you a rundown on the basics of cryptocurrency and blockchain with the aim of getting you comfortable with cryptocurrencies and blockchain technology. Before going over the specifics you will take a look at the context in which Bitcoin was launched into the world.

This course is 2-3 hours long. Breaks may be helpful for discussion, but the content has been disnged to hold questions until the end.

Blockchain Institute is a United States 501(c)(3) non-profit charity whose mandate is to provide education to the public

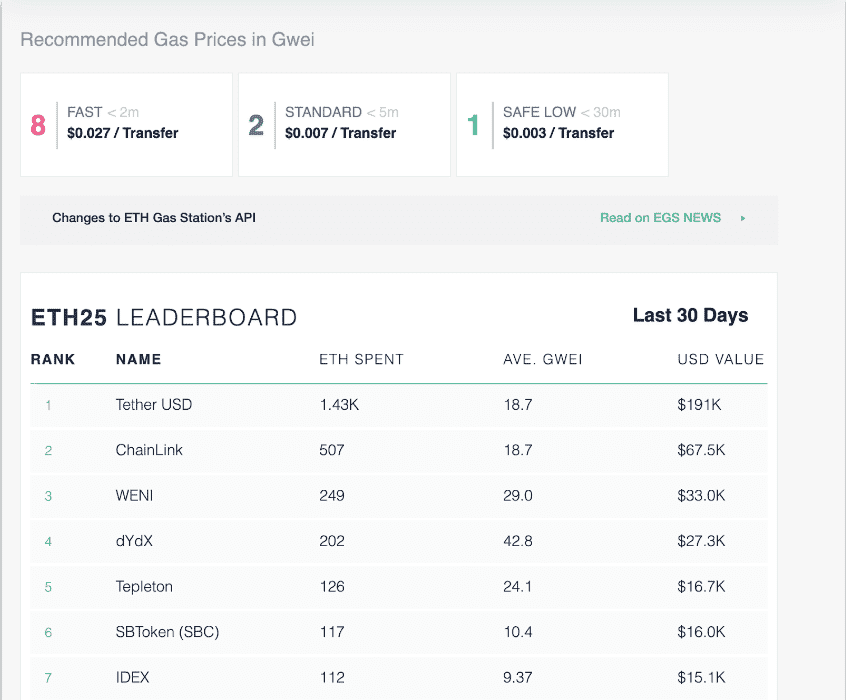

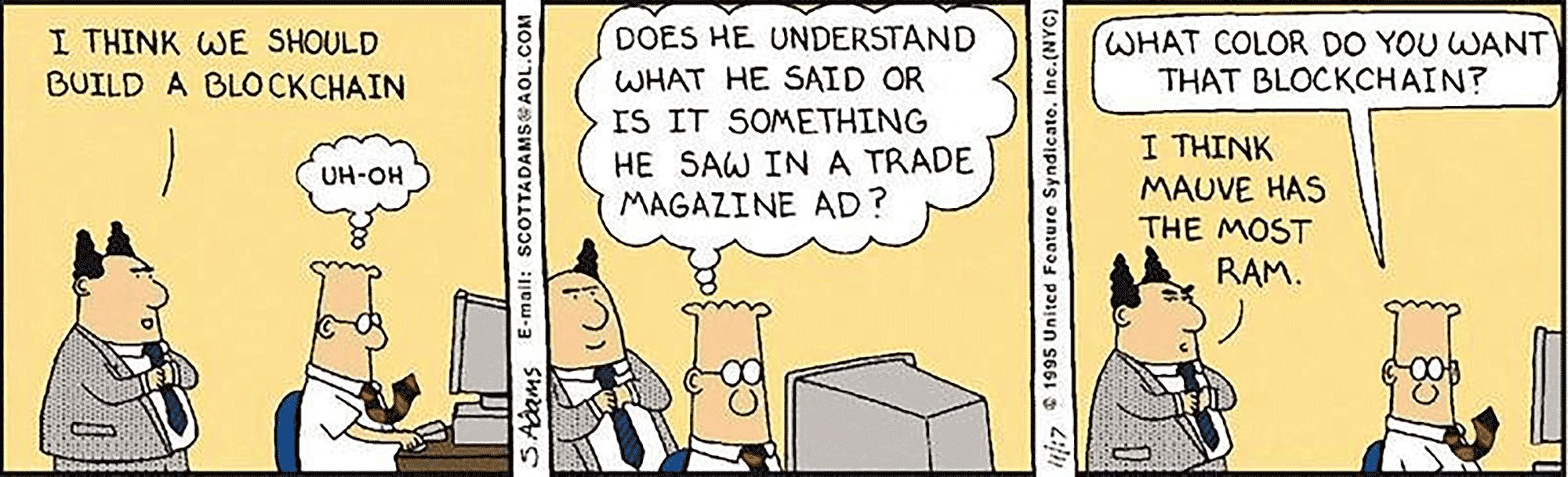

Smart contracts have the possibility to revolutionize how business is done over the internet

May lead to innovation in a variety of industries:

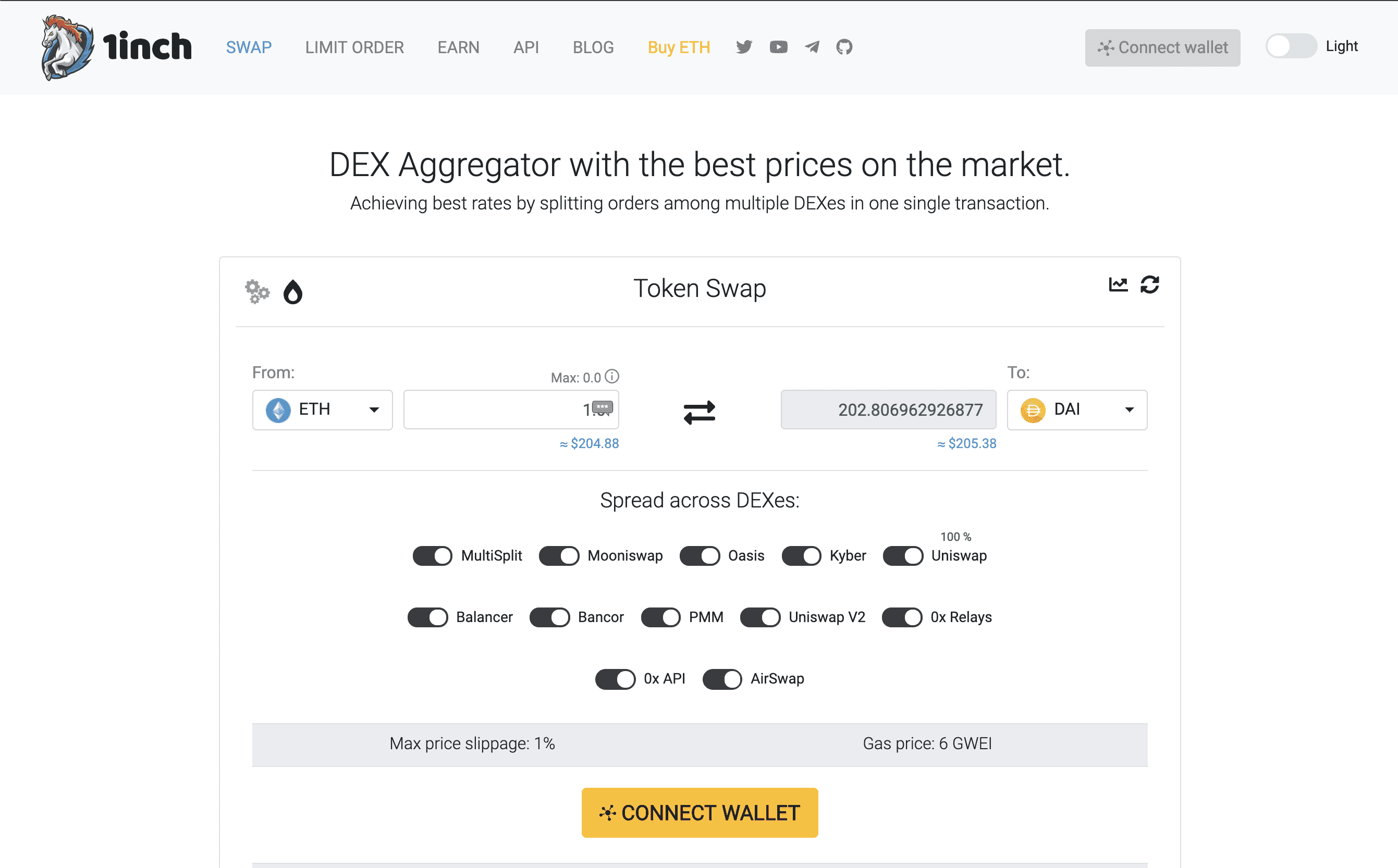

Bringing Decentralized Technology to our internet

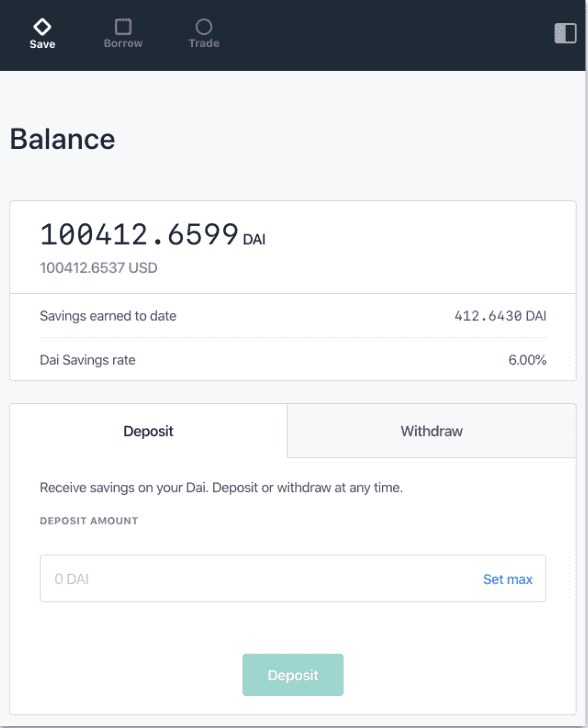

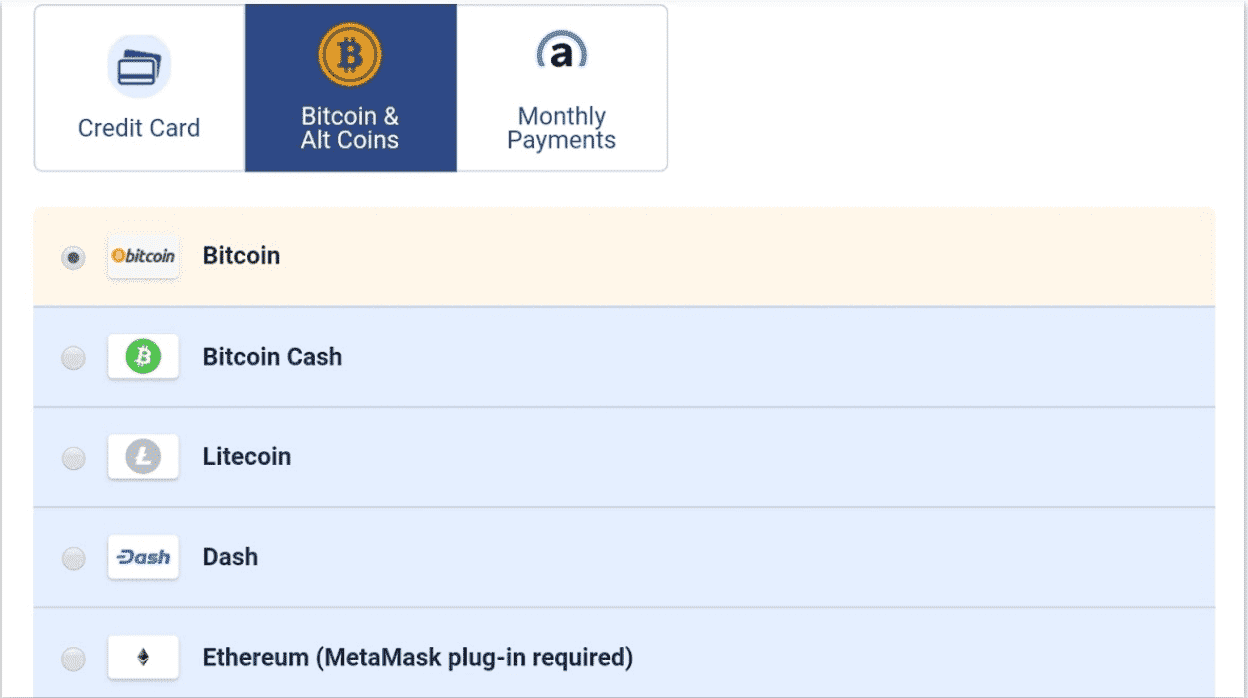

Microtransactions